Second home mortgage how much can i borrow

A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. You may qualify for a larger loan if you.

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Keep in mind that restrictions on what is and isnt considered a second home may apply.

/GettyImages-1081824440-2fcd29d1f0974847af9b6f57a3d2ba6d.jpg)

. Find out what you can borrow. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. For this reason home equity loans tend to have higher interest rates.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. The first mortgage on your second home.

Paying a little bit more on your monthly mortgage installments may significantly affect how much home loan you can afford. In case youre not familiar with the term a second mortgage otherwise referred to as a Home Equity Loan is simply a loan taken out against your home after you already have a first mortgage. First time buyers can take out a mortgage of up to 90 of the purchase price of a home.

Can your budget withstand these additional obligations. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

Unlike a cash-out refinance a home equity loan doesnt replace the mortgage you currently have. Please get in touch over the phone or visit us in branch. A lender reviews your income assets and debts based on self-reported information.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. At 60000 thats a 120000 to 150000 mortgage.

Both loans borrow against your homes equity but one gives you the money in a lump sum and the other lets you take the money as you need it. Second time buyers can take out a mortgage of up to 80. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

How Much Mortgage Can I Afford if My Income Is 60000. Or 4 times your joint income if youre applying for a mortgage. This mortgage calculator will show how much you can afford.

For example you can only rent the home for up to 180 days a year. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. How much can I borrow.

A home equity loan is a second loan thats separate from your mortgage and allows you to borrow against the equity in your home. You can compare mortgage loan terms to see how different mortgage agreements impact your homebuying budget. Its important to put a second mortgage or a home equity line of credit in with the rest of your consumer debt in your debt payment plan.

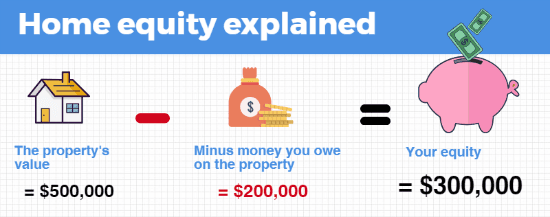

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. What is Second Mortgage. Home equity is the difference between what you owe on your mortgage and what your home could sell for on the current market.

The maximum amount you can borrow with a home equity loan depends on how much equity you have in your property. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment. The last thing youd want is a second home to financially devastate your family and put you at risk of losing your main.

It usually takes just one to three days and can be done online or over the phone. This mortgage finances the entire propertys cost which makes an appealing option. You can purchase a second home with 5 down as long as the property is intended for family use throughout the year and the mortgage is under 500000 says Samantha Brookes CEO of Toronto.

However as a drawback expect it to come with a much higher interest rate. However bear in mind that not all of this will be accessible with lenders only allowing you to borrow 80 of the propertys value without being charged for Lenders Mortgage Insurance LMI. Conventional loan requirements are higher for people who want to buy a second home.

C onventional loan. You can usually borrow as much as 80 or 85 of your equity depending on a few factors. Basically a second mortgage allows the borrower to tap into the equity they have accumulated over the course of repaying their.

Before making a decision take all costs into consideration. It allows home owners to borrow against. Enter your details in the calculator to estimate the maximum mortgage you can borrow.

To qualify for a loan on a second home youll need a down payment of at least 10. Adding to your down payment also increases how much home you can afford. For example if your home is worth 700000 and there is 300000 remaining on your home loan you have home equity worth 400000.

After performing the calculation you can transfer the results to our mortgage comparison calculator where you. And keep in mind that the interest rates on. The usual rule of thumb is that you can afford a mortgage two to 25 times your income.

Instead its a second mortgage with a separate payment. The second mortgage home equity loan or HELOC on your main home.

Can I Afford A Second Home Calculator Vacation Property Online

Seconds Home Mortgage Rates Are Going Up In 2022

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Top Tax Deductions For Second Home Owners

How To Use An Fha Loan To Purchase A Second Home

Buying A Second Home A How To Guide Rocket Mortgage

How To Buy A Second Home With No Down Payment Smartasset

How To Buy A Second Property With No Deposit Equity Explained Finder

Second Homes To Become Pricier Despite Low Interest Rates Marketplace

Fha Loan Rules For Second Homes

Using A Cash Out Refinance To Buy A Second Home A Good Idea Credible

Second Home Mortgage Calculator Vacation Property Online

Family Home Loans Family Friendly Neighborhoods Real Estate Investing

5vjvisnbhz4mtm

Why Is Home Equity Important Www Facebook Com Sklentzeris Mortgages101 Mortgage Homesale Homebuying Realtor Sandykle Home Equity Home Equity Loan Equity

Second Home Mortgages Uswitch Explains

/GettyImages-1081824440-2fcd29d1f0974847af9b6f57a3d2ba6d.jpg)

How To Afford A Second Home